Getting a Construction Mortgage to Build or Renovate Your Home

Can you imagine standing in the middle of a vacant plot of land and the sun shining down on a lot of possibilities? You must be able to visualize the home of your dream rising from the ground, every brick laid with extreme care, and every room well-designed to achieve perfection. The achievement of this vision and its transformation into reality primarily demand more than imagination. You would require a construction mortgage to achieve your vision.

When you decide to start the journey of building your dream home or renovating your existing property, the process can be exciting as well as daunting. A construction mortgage is a crucial financial tool that makes it possible to turn your dreams into reality. Suppose you are willing to construct a new home right from scratch or undertake some specific renovations to your existing property. In both these cases, understanding the process of construction mortgage is essential if you want to opt for the same. Here, we will discuss about the process, various requirements, & benefits of securing a construction mortgage. We will also provide you with certain insights on how it differs from traditional mortgage.

Understanding the Concept of Construction Mortgage

A construction mortgage is a kind of mortgage that is specifically designed to finance the construction of a new building or to undertake a renovation of a home. Unlike several traditional mortgages that are being used for purchasing your existing properties, construction mortgages cover the costs that are associated with constructing a new home or making certain significant improvements to an existing property. The funds that are opted for constitute a construction mortgage. The amount is usually disbursed in stages, referred to as draws. These draws are disbursed in trenches with the progress of the construction.

All About the Working of a Construction Mortgage

When you opt for a traditional mortgage, you receive the funds for the purchase of your house upfront. So, if you are purchasing a house worth $500,000 with a $25,000 down payment, then the amount you will receive through your conventional mortgage is a lump sum of $494,000 (mortgage amount of $475,000 + CMHC insurance of $19,000).

When you opt for a construction mortgage, you will receive your funds in stages, which are referred to as draws. Most lenders will lend only a percentage of the total cost of construction. The lender will usually fund 75% of the total price, and you must make a down payment of 25% from your own funds.

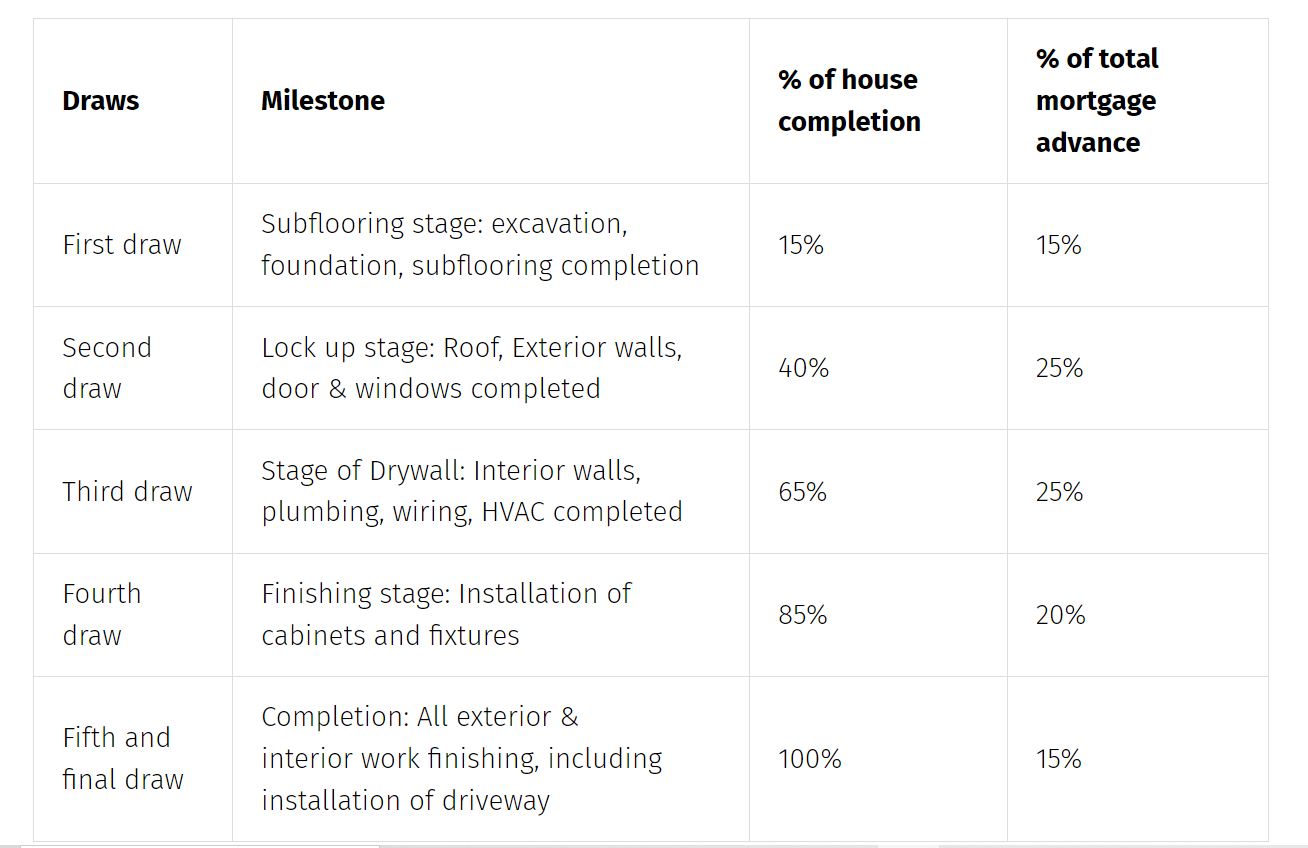

Following is an instance that represents the schedule of a construction draw.

If you do not have the piece of land where you are planning to build your home, then some lenders will disburse the first draw to purchase the land. Under such circumstances, you will have to mandatorily cover up to 35% of the total cost of the land. On the contrary, if you already have a running mortgage on the land from some other lender where you are planning to build your house, your construction mortgage lender will only release the first draw when you pay off that mortgage completely.

Different Kinds of Construction Mortgages

- Construction-to-Permanent mortgage – If you are constructing a new home, then this type of mortgage is intended to initially fund the construction phase & then convert into a permanent mortgage once the property’s construction is over. It simplifies the overall financing procedure by combining two mortgages into one. This reduces the need for multiple closings & associated costs.

- Stand-Alone Construction mortgage – In this case, you take out a mortgage to build your house. Once the construction of your house is completed, you can secure a separate permanent mortgage. This is also referred to as a two-time-close mortgage. Opting for this option undoubtedly provides a higher level of flexibility in terms of lender choice. However, it needs two different closings & the potential cost is high.

Requirements for Receiving a Construction Mortgage for Home Building

There are certain requirements for opting for a construction mortgage. These requirements may vary depending on the nature of the lender. Some of the most obvious requirements are:

- Strong Credit Score—A strong credit score is one of the primary requirements to be eligible for a construction mortgage for a home building. Lenders offering construction mortgages usually prefer a credit score of 680 or higher. The credit score indicates the borrower’s creditworthiness and ability to repay the mortgage.

- Down Payment – The down payment is the initial investment that you make in your dream home. Construction mortgages usually require a higher down payment than traditional mortgages. Most lenders typically demand a down payment of between 20% and 30% of the entire cost of the project. This particular requirement signifies that a concerned borrower has a significant financial stake in the project.

- Detailed Plans of Construction— Construction mortgage lenders necessarily ask for construction plans. These include project timelines, architectural drawings, and cost estimates. These documents usually help the lender evaluate the overall scope and feasibility of the project.

- Qualified Contractor or Builder—It is essential that you choose a reputable and qualified contractor. Lenders often require proof of the builder’s experience, credentials, and financial stability to ensure that the project will be accomplished seamlessly and successfully within the estimated and committed timelines.

- Proof of Financial Stability and Income—Your proof of income signifies your financial stability. Borrowers usually require proof of income, such as tax returns, pay stubs, and bank statements. These documents genuinely demonstrate their overall ability to repay the mortgage they will be taking. Lenders usually evaluate the concerned borrower’s debt-to-income ratio to understand their present financial stability completely.

What is a Renovation Mortgage?

Construction mortgages are not merely available for new house construction. They can also be used for several significant renovation projects for your home. For instance, if you want to transform your dated kitchen into an altogether modern culinary haven, then you will surely require a major renovation drive. Renovation mortgages for homes are a subset of construction mortgages and are strategically designed to finance house improvement initiatives to enhance their functionality and value.

Kinds of Renovation mortgages for Home

- Home Equity Line of Credit (HELOC)– This is a flexible credit line that you can tap into whenever you require funds for certain ongoing renovations for your home. A HELOC allows a homeowner to borrow against the equity on their home to finance certain renovation projects. The best part is that it provides a flexible credit line for financing house renovation projects. It is also suitable to be opted for ongoing house renovations.

- Cash-Out Refinance—In this case, you can refinance your mortgage and withdraw extra cash to fund your house renovation and improvement. This option majorly involves refinancing your existing mortgage to access the equity in your property. The additional funds received will be used for your house renovation projects.

Construction mortgage Versus Mortgage

Understanding the differences between a construction mortgage and a traditional mortgage is essential when planning the construction or renovation of a house.

1, Purpose

- Construction Mortgage: This is designed to finance the construction or renovation of a house.

- Traditional Mortgage – It is used to purchase an already existing property.

2. Disbursing of Funds

- Construction mortgage—In a construction mortgage, funds are disbursed in stages or draws based on the progress of the house’s construction.

- Traditional Mortgage—In a traditional mortgage, the entire mortgage amount is disbursed all at once to buy an existing house/property.

3. Term of Mortgage

- Construction Mortgage—This is typically a short mortgage disbursed within a year, during which the house is constructed.

- Traditional Mortgage –A traditional mortgage has longer terms, which range from 15 to 30 years.

4. Interest Rates

- Construction Mortgage –Construction mortgages often have variable interest rates that change with changing market conditions.

- Traditional Mortgage –Traditional mortgages usually have variable and fixed interest rates that may change periodically or remain constant.

5. Conversion

- Construction-to-Permanent Mortgage – It converts into a permanent mortgage once the construction of the house is completed.

- Stand-Alone Construction Mortgage – A separate permanent mortgage is required after the construction phase.

Construction Mortgage’s Closing Costs

It is very crucial to consider the closing costs before opting for a construction mortgage. These costs can, to a large extent, depend on the lender and the specifics of the mortgages usually include:

- Origination Fees

The borrower should inquire about the administrative cost of setting up the mortgage. The origination fees usually cover the lender’s costs for processing the mortgage application. They are usually a typical percentage of the mortgage amount. - Appraisal Fees

An expert is involved in evaluating the overall value of your house/property. So, an appraisal fee is being charged for the evaluation of the property, both before and after the construction/renovation of the property. - Inspection Fees

The inspection is part of a quality check during the construction phase of the home. During this phase, lenders usually require periodic inspections to ensure that the project is progressing as per plans. Inspection fees are being levied to cover the cost of these routine evaluations. - Title Insurance

Title insurance is intended to protect your rights of ownership. Title insurance protects the borrower and lender against any legal issues that are related to the title of the property. The cost of title insurance usually varies based on the location and value of the property. - Legal Fees

A legal expert will review your construction mortgage documents. Legal fees usually cover the cost of hiring a legal attorney to review the mortgage documents. It ensures compliance with all the legal requirements. - Survey Fees

The lender is verifying the property on which the construction mortgage is opted for. The boundaries of the property are being verified. Certain survey fees are charged to verify the property’s boundaries and ensure that the construction complies with local zoning laws. - Interest Reserves

Certain funds are being set aside to cover interest payments during the construction phase. Lenders may necessarily require an interest reserve account to cover these payments when the property has not yet started to generate income.

Tips for Successfully Opting for a Construction Mortgage

Opting for a construction mortgage can be a complex process. Here are some tips to help you navigate the journey.

1. Choosing the Right Lender

It is very important to select a lender with experience in construction mortgages. They will understand all the unique requirements and challenges associated with these mortgages and can provide valuable guidance.

2. Getting Pre-Approved

Getting pre-approved for a construction mortgage helps you understand your budget. It also demonstrates to contractors and builders that you are a qualified and serious buyer.

3. Working with Experienced Professionals

Collaborating with reputed and experienced builders, architects, and contractors is very important for the success of your project. Their expertise will rightly ensure that your construction or renovation is completed on the expected time within a set budget.

4. Preparing an Extensive Budget

Creating a detailed budget is crucial. It includes all the necessary aspects of the house’s construction or renovation project. It helps prevent cost overruns and ensures that you possess enough funds to complete the project.

5. Staying Completely Involved in the Process

You should communicate with your contractor or builder regularly and stay involved in the construction procedure. This particular involvement usually allows you to address all the issues promptly, which ultimately ensures that the project stays on the right track.

FAQs

- What are the requirements for being eligible for a construction mortgage?

To secure a construction mortgage, you must have a good credit score (usually 680 or above), a substantial down payment (20% to 30%), proof of income, detailed construction plans, and, most necessarily, financial stability. Last but not least, you will require a qualified contractor or builder. - Can I opt for a construction mortgage for a renovation project?

Yes, you can opt for a construction mortgage for a renovation project. These mortgages are also referred to as renovation mortgages. These mortgages are meant to be utilized for big home improvements that are intended to increase the functionality and value of an existing property. - What are the closing costs associated with a construction mortgage?

The closing costs for a construction mortgage can include origination fees, inspection fees, appraisal fees, legal fees, title insurance, survey fees, and interest reserves. These costs usually vary from time to time depending on the chosen lender and the specifics of the construction mortgage.

Conclusion

To opt for a construction mortgage to build or renovate your home is indeed a complex but rewarding procedure. Understanding all the requirements and the differences between construction mortgages and traditional mortgages is very important for achieving success. Working with experienced professionals, preparing detailed plans & budgets, and staying actively involved in the procedure can potentially turn the construction of your dream home or renovation project into a reality. Whether you are building your house from scratch or transforming your home by undertaking a renovation project, a construction mortgage can help you realize your dreams.

By following the above guidelines and tips outlined, you can easily navigate all the complexities of construction mortgages. This will help you successfully complete a home-building or renovation project. Finally, you will be able to stand in your completed home, where every detail reflects your hard work and vision, ultimately making your dream come true.

Post a comment